Automated Balance Transfer Tool

Automated Balance Transfer Tool

Context

At Mountain American Credit Union (MACU) we strive to help Members reach their financial dreams. One way to help our Members achieve their goals is through debt consolidation. Our service center at MACU is often the first point of contact with MACU Members when they call in. When a rise in high-interest rate lines of credit was disclosed to service center agents we saw an opportunity to build a tool to help consolidate debts and provide value to our Members.

Why (as a business) would we care about Member's external financial affairs? We have a service guide at MACU. AAA stands for Assess, Advise, Assist. AAA is how we engage with our members and with each other. At Mountain America, our members are our primary focus, and the member experience drives everything we do. AAA is the key component in driving our mission and vision by providing our members with exceptional experiences and helping them define and achieve their financial dreams.

Problem

Manually printing and envelope stuffing checks at the branch and service center was laborious and time intensive.

Sending all payments via physical paper checks through regular mail. Occasionally checks were lost in the mail.

Employees manually searching for merchant and payee billing addresses ended up empty handed in their searches.

Understanding the User Needs

How We Did It

Service Center Team’s feedback channels.

Discovery interviews with service center agents to understand the entire balance transfer process as it exists.

Worked with service center agents to help us understand the user needs from their perspective.

Key Takeaways

Ability to automate balance transfers from the FIS payment product.

Develop an omni-channel Balance Transfer product that will be used in branches and service center (online branch, mobile app, and ALPS in future phases of development).

*Using the FIS automated payment remittance product.

Requirements

We needed to use a remittance tool to complete ACH transactions

Using the FIS remittance tool placed us in a constraint to create a viable solution. Part of the FIS tool helped us reach a goal with a built in merchant picklist. So, part of our solution helped to reduce user-error by auto-populating payee billing addresses.

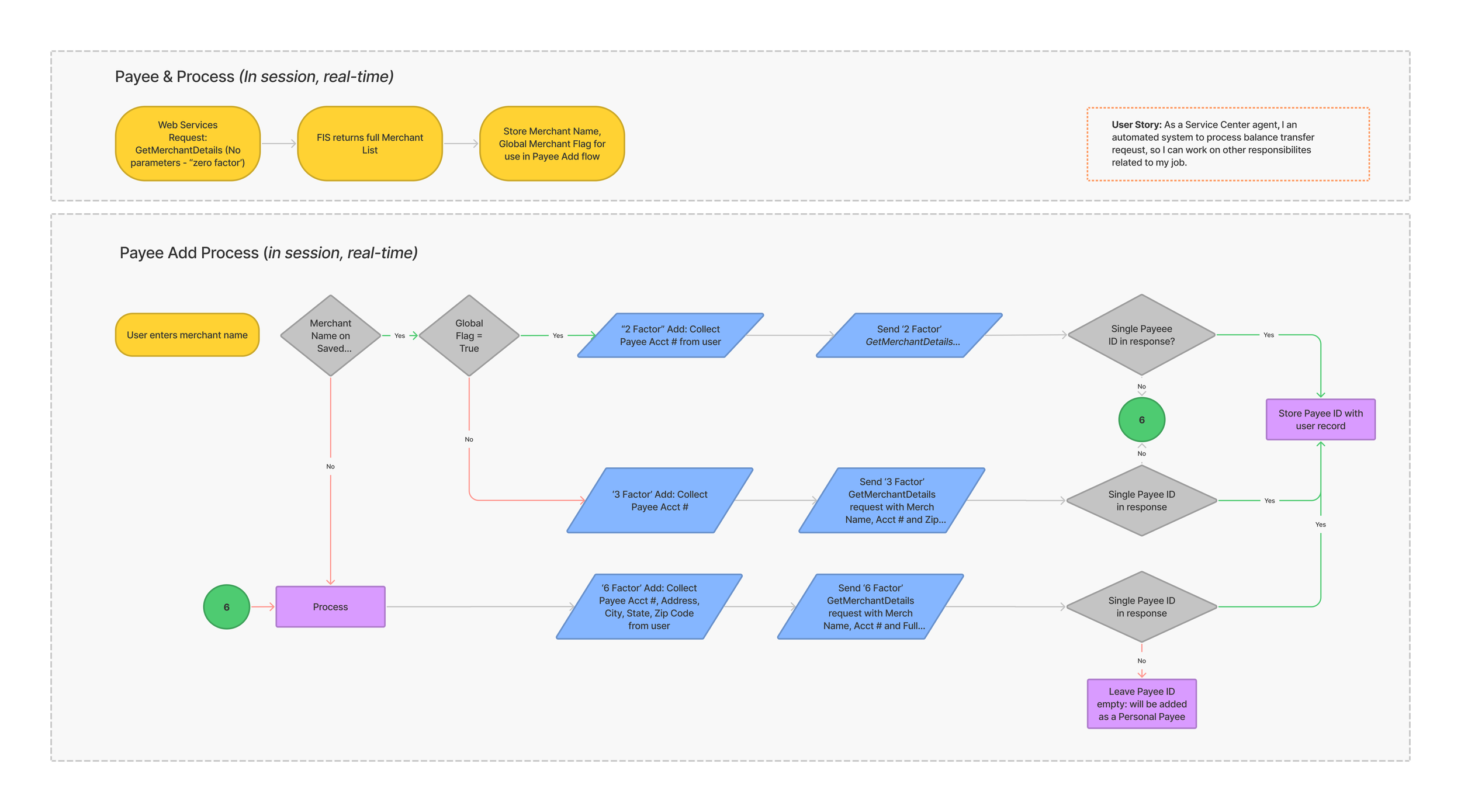

FIS Remittance flow

Mountain American Credit Union needed an automated solution to cut down the number of calls coming into the service center and decrease labor hours of physically writing and cutting checks.

Ideate

How I did it

Initial paper and pen sketching.

Usage of ALPS design system. It is sometimes more valuable to talk about and justify ideas when they look and feel real.

Understand the process flow from an FIS process.

Collaborate

Prototype

We wanted to find out

Will users understand when a 6 Factor authentication request is required versus a 2 Factor Authentication?

Can service center agents understand how to use the merchant picklist to locate a payee?

Is there clear information to provide a Member with an estimated time of payee payoff?

Final Solution

The Results

Until we developed the Automated Balance Transfer Payoff Tool, the debt consolidation process required manual work and was vulnerable to user error. Each account consolidated had to be paid off by mailing physical checks instead of sending a digital ACH transfer.

Within six months of implementation

1,000 hours saved

The balance transfer tool had saved employees over 1,000 man-hours which freed them up to complete other tasks related to their jobs.

6,000 checks

Within six months of launch we eliminated the printing and mailing costs for over 6,000 checks.

90% of payments were sent electronically

Reduced the writing of checks in branches and service centers by sending 90% of balance transfer payments electronically using the automated clearing house (ACH) technology.

How Would I Improve this Feature Further?

Visually I would have wanted to push the UI to be less flat and used more color and shadow to create depth and dimension around the components. At the time of discovery, I wanted to add a feature to show transaction history. From what we knew about our users and the infrequent use of usage patterns we decided against it. Ask yourself how often someone would ideally transfer a high-interest credit card to a low-interest line of credit. Maybe once a year? Once every two years? Probably.

Though given the AAA service guide the Automated Balance Transfer Tool won’t be used as a one-off service. Because Members use our lending for cars, homes, and recreational vehicles the tool will be leveraged anytime our loan officers see an opportunity to advise a Member to consolidate and save money where it makes the most sense.

Final Accolades

Mountain America Credit Union received the Credit Union National Association’s (CUNA) Excellence in Tech Award for our Automated Balance Transfer Payoff Tool. This wasn’t an award we were seeking to obtain, but the hard work of our developers, project & product managers assisted in bringing this tool to the credit union and brings continuous innovation to the industry.